While communicating with management, I aim to establish optimal targets for various financial indicators and contribute to supporting Nifco’s sustainability management.

I would also like to commit myself to investor relations activities and increase Nifco fans.

Hiroshi Hamada

General Manager of Finance & Accounting Department, Management Control Headquarters

Q1: Please tell us about your current job as the General Manager of Finance & Accounting Department.

The Finance & Accounting Department is part of the Corporate Management Headquarters, and its primary role is to oversee financial indicators pertaining to financial settlements and management, and to report these figures to CEO Shibao and management. Our main role as accounting is to prepare monthly, quarterly, and annual financial statements and to disclose them promptly and accurately to internal management and external investors. Financial statements reflect the true state of a company’s activities, so they are uniquely interesting and have depth. The main duties in finance include managing the numerical values of various KPIs (key performance indicators), which are management indicators such as ROE (return on equity), and raising funds.

The other area is IR (Investor Relations), which has become my main focus since this year. The role of IR is to communicate with investors, but while carrying on former CFO Yauchi’s belief that “the most important thing is to correctly convey the company’s value,” we are also exploring ways to bring out Nifco’s unique approaches while maintaining close communication with CEO Shibao.

A representative indicator of a company's value is its stock price. If Nifco's stock price is lower than we expected, we will endeavor to raise this by communicating the company's value and appeal to investors, and conversely, if the stock price is higher than we expected, we will endeavor to keep it at an appropriate level. An excessively high stock price can also indicate that market expectations have become too elevated, so if our performance fails to meet those expectations, the company’s credibility will decline together with stock prices. Credibility takes time to recover, and as an IR representative, I am committed to correctly communicating the value of our company.

Q2: Please share your reflections on the company’s performance for FY2024.

FY2024 was a very strong year in terms of performance. The operating profit margin remained high at 13.9%, and ROE, which had fallen to single digits at 7.8% in FY2023 due to extraordinary losses from the sale of the German business, improved significantly to 17.3%. One of the major reasons for the strong performance is we now have almost no loss-making locations. Nifco operates globally, and each of its locations generated profit in FY2024. The recovery in North America, which had been struggling for some time, was particularly significant.

FY2024 was also a year in which we focused on shareholder returns. Our basic policy until FY2023 was to maintain a dividend payout ratio of approximately 30%, but for FY2024, we aimed for a total shareholder return ratio (an indicator showing how much of profit is returned to shareholders), which combines dividends with share repurchases, of 45% or higher, and ultimately achieved 52%. Our conducting of the largest share repurchase in our history to quickly restore ROE to double digits contributed to increasing the return ratio. We will continue to actively return profits to shareholders.

Q3: Please tell us about the business outlook for FY2025 and the key financial indicators you are focusing on.

As part of Nifco's culture, one of the financial indicators that we place great importance on is the operating profit margin. While we naturally place importance on sales as the source of profit, what we are particularly focused on is the operating profit margin. As I mentioned earlier, our operating profit margin was 13.9% in FY2024, and we expect it to rise by 0.3 points to 14.2% in FY2025. Since its founding, Nifco has made creativity its corporate motto, and has strived to provide products and services with unique added value that no other company can offer. The higher the added value, the higher the price of the product or service can be set, which increases profits and improves the operating profit margin. The growth in operating profit margin can be seen as a result of our creativity. That is why we place importance on operating profit margins.

Furthermore, we are also paying close attention to ROE and ROIC (Return on Invested Capital). We forecast ROE of 12.0% and ROIC of 18.0%. These figures are expected to fall below the FY2024 results, due to the Trump tariffs. Nifco’s sales can be roughly calculated as “the number of automobiles produced × the value of Nifco products installed per vehicle.” When preparing the budget for FY2025, the tariff rate on automobiles had not yet been determined, so we had to take into account the impact and prepare the budget under the assumption that the number of automobiles produced would be on a slight downward trend compared to FY2024.

In terms of financial indicators, we are also currently searching for an appropriate value for the equity ratio (the ratio of equity to a company’s total assets). The current equity ratio is 77%. Since the proportion of shareholders’ equity such as capital from stock issuance and accumulated profits is high, and the proportion of debt such as loans and corporate bonds is low, we can assess that our figures are financially sound. However, from the perspective of whether the company's funds are being used efficiently, there are various opinions on this, such as whether it is too high, too low, or just right. We would like to determine the appropriate value for Nifco.

Q4: Please highlight the key financial strategic points in Nifco’s Mid-Term Management Plan for FY2025 through FY2027.

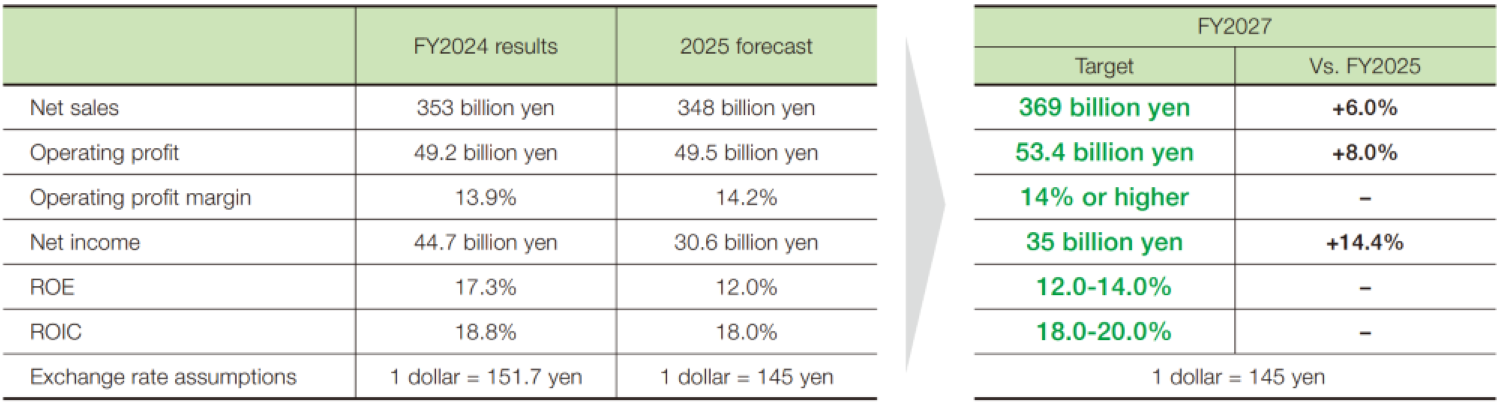

First, for the key numerical targets for FY2027 (see chart), we are looking at an operating profit margin of 14% or higher, ROE of 12-14%, and ROIC of 18-20%. Sales are expected to reach 369 billion yen, representing a 6% growth from FY2025. For Nifco, by increasing the installed value of its products, it can expect to grow by around 3% per year even if the number of automobiles produced does not increase. This translates to a growth rate of +3% from FY2025 to FY2026 and +3% from FY2026 to FY2027, for a total growth rate of 6%, but this is still a conservative calculation. When explaining Nifco’s business outlook for FY2025 in Q3, we mentioned that we had made a lower estimate taking into account the impact of the Trump tariffs. The Mid-Term Management Plan for FY2025 to FY2027 was created based on the FY2025 performance forecast, so the sales growth rate was set conservatively.

■ Numerical targets in the Mid-Term Management Plan

However, with the Trump tariffs now set at 15%, sales growth could potentially exceed 6%. Additionally, Nifco also plans to continue investing in growth over the next three years. This is also likely to be a factor in further increasing the growth rate.

Regarding investments in existing businesses, we have plans to construct an R&D Center (R&D facility) in China and invest in software and hardware, including digital transformation in Japan. We plan to respond quickly to Chinese-owned automakers through our R&D Center in China. The products that Nifco manufactures are not subject to the number restrictions of four per car, as are tires. Depending on our creativity and ideas, we can increase both the number and value of components installed, which means there is still ample room for growth even within the existing automotive sector. While we are not yet at the phase where we can announce our new business, we are making steady progress. We also have plans to utilize Nifco’s channels, which include all Japanese automobile manufacturers, to market mobility products through partnerships and M&A with other companies.

Regarding shareholder returns, we aim for a total return ratio of 45% or more from FY2025 onwards, and will strive to continue stable dividends and agile share buybacks. For dividends, we aim to meet investor expectations by increasing dividends every year. Regarding share buybacks, we will proactively implement them so that we can purchase them efficiently when stock prices are low. Buying when the stock is cheap also sends a message to the market that “Nifco is not satisfied with this stock price.” We will also be fully committed to IR activities for individual investors. By communicating Nifco’s appealing features, we will increase the number of Nifco fans.

Q5: As General Manager of Finance & Accounting Department, what would you like to do next to achieve sustainability management?

Together with the growth investments in its Mid-Term Management Plan, one of Nifco’s major challenges is how to spend its money. The cash balance is expected to reach 120 billion yen by the end of FY2027, three years from now. The key challenge is to invest this effectively to drive further growth and profitability.

To support this, we would like to set target values for various financial indicators. Financial statements are numbers that show the results, so basing management solely on them is like driving while looking at the rearview mirror. I believe that my role as General Manager of Finance & Accounting Department is to incorporate a financial perspective into this and use it to lead to positive management. Specifically, I intend to work with management to determine what percentage levels of key indicators such as operating profit margin, ROE, and equity ratio would represent the optimal targets for Nifco. We believe that setting appropriate targets for each key financial indicator and working to achieve them will lead to growth and sustainable management for Nifco. We would like to support the achievement of a virtuous cycle in which the money earned is used efficiently to generate further profits, or cash, from a financial perspective. Through my work in finance and accounting, I hope to convey Nifco’s appealing features and increase Nifco fans.

- CEO: Nifco's Sustainability Management

- Message from Outside Directors

- Roundtable Discussion: Between the President and Employees Involved in Technology

- Dialogue: Next-generation Growth Strategies Focused on Solving Social Issues

- Dialogue: Nifco's Response to Climate Change

- Dialogue: Nifco's concept of human capital