Nifco Inc. hereby announces that its Board of Directors resolved at the meeting held on May 17, 2024 to adopt the Officer Nomination Polices and the Officer Compensation Polices for FY2024 and beyond.

Announcement of Officer Nomination Policies and Compensation Policies

Basic philosophy regarding corporate governance

Our company has continued to grow based on the Nifco Spirit, which has been cultivated since its founding in 1967 and has a "challenge spirit" and "creativity" at its core. Based on this history, and with the determination to move forward to a further stage of growth, we have once again established our company's Purpose/Mission/Values as follows.

Starting from the "My Purpose" that each employee has, by fulfilling our Mission through our company's Values and realizing our company's Purpose, we will grow sustainably while maintaining the uniqueness of Nifco and we aim to become a company that continues to be trusted by all stakeholders, including employees, customers, shareholders, investors, users, partner companies, and local communities.

-

Purpose

-

Sparking Innovation by fastening small insights with Technology for a better world

-

Mission

-

Generate excitement as a creative company

-

Values

-

Overcoming Challenges

Continuous Breakthroughs

Open Communication

Innovative Collaboration

We consider it necessary to respond to the drastically changing social and economic environment flexibly and appropriately by strictly enforcing compliance and implementing appropriate risk management. At the same time, we believe it important to thoroughly disseminate and practice such principles.

Based on the above philosophy, we endeavor to fully implement corporate governance as a priority issue, and to promote reinforcement of Group management.

Officer Compensation Policies

1. Required elements for Chief Executive Officer (CEO)

The anticipated candidate profile of CEO of the Company is an individual who can realize and embody Nifco’s corporate philosophy (Purpose, Mission, Values). Based on the philosophy of corporate governance described above, the Company has defined the required elements (responsibilities and authority, main duties, expected results, competency, knowledge and skills, mindset, experience, etc.) for the CEO. The details of the competency and mindset are as follows.

Required elements |

Description |

|

|---|---|---|

Philosophy・ |

Realization of corporate philosophy |

|

Ethical standards |

|

|

Competency |

Establishment of vision and strategy |

|

Promotion of Diversities |

|

|

Transformation leadership |

|

|

Breakthrough |

|

|

Response to changes |

|

|

Construction & reinforcement of organization |

|

|

Personality and virtue |

|

|

Learning ability and curiosity |

|

|

Passion and commitment |

|

|

2. Appointment and dismissal criteria

The Company shall appoint and dismiss senior management officers with an emphasis on their understanding of the business environment and management conditions that are necessary for formulating management strategies and ability to demonstrate strong leadership in promptly and properly executing the management strategies set forth by the Board of Directors as well as their experience, particularly in global business.

The Company shall appoint the CEO in consideration of the advice and recommendations of the Nomination, Compensation, and Governance Committee based on the required elements for a CEO described above.

The Company shall dismiss the CEO based on discussions held promptly by the Committee and the Board of Directors, should any act that raises suspicion of meeting the following criteria for dismissal arise.

-

When there has been an act suspected of being wrongful, unjust or a breach of trust.

-

When he/she is found to be ineligible as CEO due to misconduct, such as a violation of the Companies Act or related laws and regulations.

-

When the qualities of the CEO are in doubt considering the business environment related to the required elements for a CEO described above.

-

When the process of performing his/her duties or the results thereof are insufficient, and it has been judged that it would be inappropriate to keep him/her in the position of CEO.

Each year, the Nomination, Compensation, and Governance Committee shall evaluate the CEO based on the required elements for a CEO described above, his/her performance, as well as other factors, and advise the Board of Directors on his/her reappointment for the following year after confirming the CEO’s plans for the coming years and his/her willingness to continue serving as CEO.

3. Succession plan

The CEO succession plan shall be discussed by the Nomination, Compensation, and Governance Committee based on the required elements for a CEO described above. Specifically, based on a selection process developed through the discussions at the Committee, periodic cycle of creating and updating a candidate pool, conducting assessments by external experts, and developing individuals is done before narrowing down the candidates. The Board of Directors shall monitor whether the succession plan is appropriately carried out based on the report on the deliberations of the Committee.

4. Term of office

The term of office of Directors who are not Audit & Supervisory Committee Members (including Independent External Directors) shall be one (1) year, and the appropriateness of their reappointment shall be determined annually.

The term of office of Directors who are Audit & Supervisory Committee Members shall be two (2) years, and the appropriateness of their reappointment shall be determined every two years.

5. Decision-making process

In order to enhance the independence, objectivity, and transparency of the details of the appointment and dismissal criteria for Directors and decision-making process for nominations, the Company established the Nomination and Compensation Committee on December 10, 2018 as an advisory body of the Board of Directors, and it is chaired by and a majority of its members are Independent External Directors. The Committee was then renamed the Nomination, Compensation, and Governance Committee on October 28, 2020, in order to further strengthen the Company’s actions on corporate governance.

The Nomination, Compensation, and Governance Committee, in principle, convenes no fewer than four (4) times a year, and deliberates mainly on the Directors’ appointment and dismissal criteria and the CEO succession plan and provides advice and recommendations to the Board of Directors.

In order to adopt an objective viewpoint and specialized knowledge from outside the Company, the Nomination, Compensation, and Governance Committee may seek advice from an external consultant or other experts on the details of the Directors’ appointment and dismissal criteria, the CEO succession plan, etc., taking into consideration factors such as external data, the economic environment, industry trends, and management conditions.

6. Engagement Policy

The Company shall promptly disclose the details of the Directors’ appointment and dismissal criteria, the CEO succession plan, etc. to its shareholders through the Annual Securities Report, Business Report, Corporate Governance Report or the corporate website, etc. that will be prepared and disclosed in accordance with various laws and regulations. In addition, the Company will actively promote engagement with institutional investors.

Officer Compensation Policies

1. Basic policy for Officer Compensation

The Company shall set the following basic policy for compensation for Directors and Executive Officers (hereinafter, referred to as “Officer compensation”) based on the basic philosophy regarding Corporate Governance.

-

Officer compensation shall be designed to contribute to the realization of our Purpose: “Sparking Innovation by fastening small insights with Technology for a better world.”

-

Officer compensation shall be designed as an independent, objective, and transparent compensation plan that is held accountable to our stakeholders, including employees, customers, and shareholders.

-

Officer compensation shall be designed to be attractive to our employees.

2. Compensation level

The Company determines the level of Officer compensation based on the abovementioned basic policy, taking into account the Company’s management environment and after examining and analyzing periodically the compensation levels of major companies of the same and of the same size using an external database, etc.

3. Structure of compensation

(1) Compensation composition ratio

The compensation composition ratio of the Representative Director, President & CEO is as follows.

It is designed so that a bonus and stock compensation accounts for more than half of the total compensation.

Compensation for Directors who are not Audit & Supervisory Committee Members, and Executive Officers consists of "Base Salary,” "Bonus" and "Stock compensation.” As for Independent External Directors and Directors who are Audit & Supervisory Committee Members, their compensation is “Base Salary” only.

The compensation of the Chairman and Director shall be based on the response to important management issues designated by CEO and the Board of Directors and the results thereof.

(2) Overview of each compensation item

① Basic compensation

Base salary is determined based on positions according to the job responsibility involved and is paid as a monthly fixed compensation to secure excellent human resources.

② Bonus (annual incentive)

Bonus is paid to provide an incentive for the contribution to improve company performance for each single fiscal year, as an incentive for the Group’s consolidated business performance.

Consolidated sales and operating profit are used as KPI for bonus assessment to strengthen the earnings capabilities, and qualitative evaluation is also incorporated. The amount of bonus shall vary in principle from 0% to 200% of the base amount.

The evaluation ratio of each indicator is as follows.

|

Indicator |

President |

Directors |

Executive Officers |

|---|---|---|---|

|

Consolidated sales |

20% |

20% |

15% |

|

Consolidated OP |

70% |

60% |

55% |

|

Qualitative Evaluation |

10% |

20% |

30% |

-

*

The target values are the consolidated financial indicators to be announced at the beginning of each fiscal year after a resolution of the Board of Directors.

-

*

Qualitative evaluation for the President & Representative Director will be conducted by the Nomination, Compensation, and Governance Committee, which is composed mainly of Independent External Directors.

-

*

The evaluation of overseas executive officers also includes the performance of their respective regions.

The target values and coefficients for each indicator are as follows:

|

Target Values |

Coefficients |

|

|---|---|---|

|

Consolidated Sales |

Consolidated financial indicators to be announced at the beginning of each fiscal year after a resolution of the Board of Directors |

Varies in the range of 0~2.0 |

|

Consolidated OP |

Sames as above |

Varies in the range of 0~2.0 |

|

Qualitative Evaluation |

To be fixed individually according to each officer’s responsibility, and the Nomination, Compensation, and Governance Committee shall decide after consultation |

Varies in the range of 0~2.0 |

③ Stock compensation (mid-to-long term incentive)

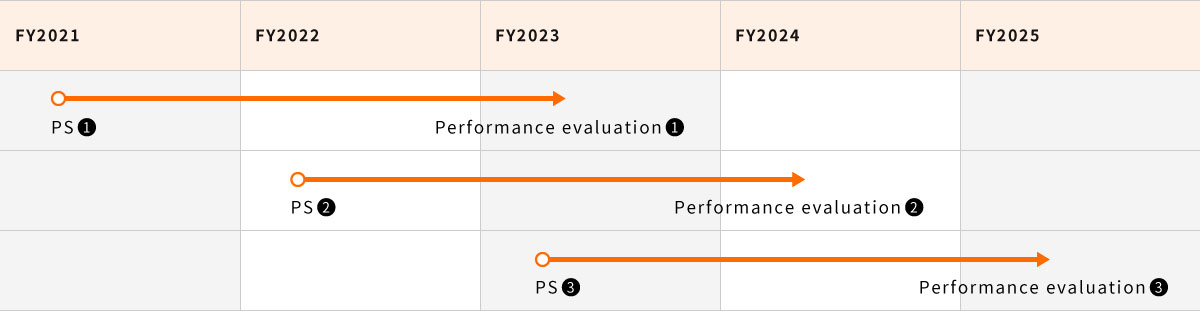

The Company’s shares will be granted to the officers with the aim of further enhancing their motivation to contribute to improve the Company’s business performance and corporate value from a mid-to-long term viewpoint and increase value-sharing with shareholders. The Stock compensation consists of performance-linked compensation (PS 50%) and non-performance-linked compensation (RS 50%).

Since 2016, the stock compensation system has been adopted in which company shares are delivered to each eligible person using a trust mechanism. Until now, points were awarded during the term of office, and the company’s stock equivalent to the number of cumulative points were awarded upon retirement. From 2024, the system is changed to a method of granting restricted shares through a trust mechanism during each officer's term of office (the "RS Trust System"), creating a system that allows its officers to share value with our shareholders even more than before.

In addition, in order to respond more flexibly to changes in the social environment, the Company has implemented a rolling Mid-Term Management Plan, in which the Plan is reviewed every year to further strengthen incentives for mid-to-long term goals in light of the perspective of shareholders and investors.

-

*

PS: Performance-linked compensation equivalent to performance shares

The performance-linked portion, which accounts for 50% of stock compensation, is determined based on the evaluation of the achievement of targets for performance indicators (Cumulative OP, ROIC, TSR) in the mid-term management plan, and is determined within the range of 0% to 200%. The above indicators will be reviewed in a timely and appropriate manner each time the rolling mid-term plan is set.

The evaluation ratio of each indicator is as follows.

|

Indicator |

Evaluation Ratio |

|---|---|

|

OP (cumulative 3 years) |

50% |

|

ROIC |

40% |

|

TSR |

10% |

The target values and coefficients for each indicator are as follows:

|

Target Values |

Coefficients |

|

|---|---|---|

|

OP(cumulative 3 years) |

Cumulative total value for the period of the targeted rolling Mid-Term Plan (for 3 years in principle). |

Varies in the range of 0~2.0 |

|

ROIC |

Value after the period of the targeted rolling Mid-Term Plan (after 3 years in principle). |

Varies in the range of 0~2.0 |

|

TSR |

Comparison against TOPIX including dividends of the day before and the last day of the targeted rolling Mid-Term Plan |

Varies in the range of 0~2.0 |

The non-performance-linked portion, which accounts for 50% of stock compensation, shall be paid as stock compensation to grant a fixed number of shares in order to further enhance the link with shareholder value for a mid to long term.

(3) Forfeiture of compensation (Malus and clawback provision)

In the event that the Board of Directors resolves to implement a correction of financial results due to a serious accounting error or misconduct or determines that there were serious, inappropriate acts during their terms of office, the Board of Directors may restrict the payment or claim the return of bonuses and Stock compensation after going through deliberation by the Nomination, Compensation, and Governance Committee.

4. Guidelines for holding own shares

The Company will promote holding of its own shares by Directors and Executive Officers in order to further raise their motivation to improve the Company’s business performance and increase its share price from the viewpoint of shareholders.

5. Decision-making process

In order to enhance the independence, objectivity, and transparency of the details of the appointment and dismissal criteria for Directors and decision-making process for nominations, the Company established the Nomination and Compensation Committee on December 10, 2018 as an advisory body of the Board of Directors, and it is chaired by and a majority of its members are Independent External Directors. The Committee was then renamed the Nomination, Compensation, and Governance Committee on October 28, 2020, in order to further strengthen the Company’s efforts on governance going forward. The Nomination, Compensation, and Governance Committee, in principle, convenes no fewer than four (4) times a year, and deliberates on individual compensation amounts and qualitative assessments to provide advice and recommendations to the Board of Directors.

In order to adopt an objective viewpoint and specialized knowledge from outside the Company, the Nomination, Compensation, and Governance Committee may seek advice from an external consultant or other experts on the details of compensation levels and systems, taking into consideration factors such as external data, the economic environment, industry trends, and management conditions.

6. Engagement Policy

The Company shall promptly disclose the details of the Officer compensation plan to its shareholders through the Annual Securities Report, Business Report, Corporate Governance Report or the corporate website, etc. that will be prepared and disclosed in accordance with various laws and regulations. In addition, the Company will actively promote engagement with institutional investors.