Last updated: September 2025

The Group sets out “Responding to climate change” as one of its materiality issues and, as its secondary issues, “Reduction of CO2 emissions in the entire business” and “Research and development, manufacturing, and the sale of products that contribute to reduction of CO2 emissions.” Accordingly, we have conducted a scenario analysis based on internationally recommended guidance. As a result, we recognize the importance of promoting initiatives to realize carbon neutrality as the Group’s medium to long-term strategy to risks and opportunities related to climate change, and have declared “Carbon Neutrality by 2050,” which represents our aim to realize carbon neutrality in 2050, with CO2 emissions of Scope 1 (emissions directly emitted by the Company itself) and Scope 2 (indirect emissions from energy sources such as electricity, heat, and steam purchased and used by the Company) as an indicator.

Governance on climate change

With regards to governance on climate change, the ESG Promotion Office, serving as the secretariat, coordinates with organizations in charge to conduct scenario analysis, identify risks and opportunities, and discuss initiatives to realize carbon neutrality.

With the ESG Promotion Office serving as the secretariat and in accordance with the Act on Rationalization of Energy Use and Shift to Non-fossil Energy and the Act on Promotion of Global Warming Countermeasures, the Environmental Promotion Committee, as an organization to ensure compliance with laws and regulations, meets once every six months to manage progress according to the plan.

In fiscal 2024, the ESG Promotion Office reported to the Board of Directors on those environment-related activities, including CO2 reduction.

Starting from fiscal 2025, the Sustainability Committee discusses risks and opportunities related to climate change, manage initiatives, and make proposals based on the results to the Management Committee. Proposals related to climate change discussed by the Management Committee are reflected in the management plans of the Company’s business departments and Group companies through the Sustainability Committee.

Strategy for achieving carbon neutrality

We have conducted an analytical assessment of the business risks and opportunities arising from climate change against projecting changes in the environment from 2021, to 2040 using a scenario analysis approach based on internationally recommended guidelines.

As a result, we recognize promoting initiatives to realize carbon neutrality as a key issue, as the Group’s medium to long-term strategy to risks related to climate change, and have declared “Carbon Neutrality by 2050,” which represents our aim to realize carbon neutrality in 2050, with Scope 1 and Scope 2 CO2 emissions as an indicator.

An overview of scenario analysis is provided below.

Scenario Analysis Overview

|

Scope of coverage |

Group consolidated companies (excluding the bedding and furniture business) |

|---|---|

|

Time line |

2021~2040 |

|

Scenario development |

|

Assumed Changes in the Business Environment Related to Climate Change

【1】Assumed Changes in the Business Environment in the 1.5°C Scenario (Mitigation Against Climate Change)

The 1.5°C scenario assumes that the average temperature in the environment may rise about 1°C above the current level by around 2040, that typhoons and cyclones may intensify, and that flooding may become twice as frequent. It is assumed that government investment will increase in response to the intensifying wind and flood damage and companies will be forced to meet more stringent standards for reducing CO2 emissions.

There is a possibility that the use of internal combustion engines may decline and there is a shift to electric vehicles, as well as the entry of new companies into the automotive industry, as the global response to climate change progresses.

In that case, customers are likely to place fewer orders for products for internal combustion engines that use fossil resources and more orders for parts required for vehicles that use electricity as well as for products designed and manufactured on the premise of reducing environmental impacts.

In addition, there is a possibility that the growing environmental awareness of automobile end-users may lead to a shift from car ownership to car sharing, which will contribute to lower global automobile production.

There is a possibility that in procurement and manufacturing, the introduction of a carbon tax may increase the procurement price of raw materials, and manufacturers may increasingly switch to raw materials such as recycled plastic and biomass plastic in response to customer demand.

The possibility of damage to supply chains and manufacturing facilities due to severe wind and flood damage may increase, resulting in irregular responses and shutdowns.

【2】Changes in the Business Environment Expected under the 4°C Scenario (Adaptation to Climate Change)

The 4°C scenario assumes that around 2040 average temperatures may rise about 2°C above the current level, typhoons and cyclones may intensify, and floods may occur about four times more frequently.

It is believed there is a possibility that government measures may be strengthened in response to increasingly severe wind and flood damage and that the number of people suffering from heat stroke may double due to rising temperatures, in addition to increasing numbers of mosquito-borne and other infectious diseases.

There is a possibility that fossil prices and energy rates will rise and that the frequency of damage to supply chains and manufacturing facilities due to severe wind and flood damage may increase, resulting in irregular responses and shutdowns.

Based on the scenario analysis as above, estimated market risks, market/technology risks and acute risks as well as market/product/service opportunities that may have impacts on the Group’s operations were identified. As a strategy to realize carbon neutrality, initiatives corresponding to those risks and opportunities are implemented in a variety of ways in the ordinary course of business by respective organizations that are in charge of responses. Of those, information on important ones are provided in “(iv) Initiatives, indicators and targets for risks and opportunities” below.

Managing risks and opportunities related to climate change

ESG Promotion Office collaborated with organizations in charge, serving as the secretariat, to identify business risks and opportunities that may arise from changes in the environment under the 1.5°C and 4°C scenarios and examine their estimated degree of financial impact. As a result, estimated market risks, market/technology risks and acute risks that may have impacts on the Group’s operations were identified. Meanwhile, under the direction of the Risk Management Committee, which is responsible for managing the Group’s risk of losses, other organizations also perform scoring of the frequency of climate change-related risks’ occurring and the amount of their impacts, as well as analysis and review on the formulation of countermeasures.

The Risk Management Committee comprehensively evaluates and manages risks related to climate change that are reported by the organizations in charge. At the same time, opportunities for climate change are also identified through scenario analysis, with the ESG Promotion Office collaborating with the organizations in charge, serving as the secretariat, to identify opportunities for markets, products and services, and the organizations in charge of responses taking action.

Starting from fiscal 2025, the Sustainability Committee identifies sustainability opportunities, manages initiatives, and makes proposals based on the results to the Management Committee. Sustainability opportunities discussed by the Management Committee are reflected in the management plans of the Company’s business departments and Group companies through the Sustainability Committee.

Risks with significant financial impacts |

Timing of emergency |

Main policies |

|

|---|---|---|---|

|

Market risks |

There is a possibility that as electric vehicles become more widespread, functional parts that are unique to gasoline-powered vehicles, such as parts for conventional engines and oil supply ports, may gradually decrease. |

Medium to long term |

|

|

There is a possibility that as more and more companies from other industries enter the automotive industry, mega-suppliers that used to supply other industries may become new competitors. |

Medium to long term |

|

|

|

There is a possibility that sales may decrease and procurement costs increase due to the inability to respond to customer requests to use recycled raw materials (e.g., biomass plastics) in a timely and appropriate manner. |

Short to long term |

|

|

|

Market risks / |

There is a possibility that Nifco’s business with existing and emerging car makers decreases due to the emergence of alternative products with lower CO2 emissions. |

Short to long term |

|

|

Acute risks |

There is a possibility that the likelihood of supply chain disruptions due to severe weather events, such as storms, snow, and freezing temperatures, has increased. This could increase the cost of purchases of expensive materials and transportation to avoid supply risks to customers caused by shortages of materials. |

Short to long term |

|

Opportunities with significant financial impacts |

Timing of emergency |

Main policies |

|

|---|---|---|---|

|

Markets / |

There is a possibility that CO2 emission reductions may lead to a rapid expansion of lighter vehicles, non-ICE vehicles, and opportunities for renewable energy use, which could increase demand for specific functional components, such as motors, batteries (including all-solid-state batteries), and braking systems. |

Short to long term |

|

Resilience to Mitigation and Adaptation to Climate Change

The analysis of our operations against the two scenarios, a 1.5°C scenario with mitigated climate change and a 4°C scenario with more intense climate change, identified relatively high-impact issues in markets, technology, and acute risks.

However, we believe that we can avoid both market and technological risks if we keep abreast of future market changes and make prompt decisions, as well as avoid acute risks if we take proactive measures. Therefore, we believe that we have a certain degree of resilience to climate change.

Initiatives, indicators and targets for risks and opportunities for climate change

【1】Important initiatives, indicators and targets for risks and opportunities related to climate change

For the business risks and opportunities arising from climate change against projecting changes in the environment from 2021 to 2040, using a scenario analysis approach based on internationally recommended guidelines, we have narrowed down and reviewed risk items for climate change that have a large degree of impact from both financial and non-financial aspects.

For market risks, over the medium to long-term, there is a possibility that as electric vehicles become more widespread, functional parts that are unique to gasoline-powered vehicles, such as parts for conventional engines and oil supply ports, may gradually decrease, and there is a possibility that as more and more companies from other industries enter the automotive industry, mega-suppliers that used to supply other industries may become new competitors.

In terms of market risks / technology risks, there is a possibility that the Group’s business with existing and emerging automakers decreases due to the emergence of alternative products with lower CO2 emissions.

As for acute risks, there is a possibility that the likelihood of supply chain disruptions due to severe weather events, such as storms, snow, and freezing temperatures, has increased. This could increase the cost of purchases of expensive materials and transportation to avoid supply risks to customers caused by shortages of materials. On the other hand, as opportunities in markets / products / services, we consider there is a possibility that CO2 emission reductions may lead to a rapid expansion of lighter vehicles, non-ICE vehicles, and opportunities for renewable energy use, which could increase demand for specific functional components, such as motors, batteries (including all-solid-state batteries), and braking systems. Major initiatives for those risks and opportunities are implemented in a variety of ways in the ordinary course of business by respective organizations that are in charge of responses. Products developed that were announced in 2024 include biodegradable plastic brush clips that emit less CO2 during production process than brush clips made from other materials, and after use they are decomposed into water and carbon dioxide, returning to nature.

All indicators for those transition and physical risks, as well as opportunities associated with climate change, have been set internally and are being implemented. Given their importance to our business strategies, they are currently kept undisclosed. In the future, we will carefully consider the possibility of disclosing such information.

Other important initiatives in fiscal 2024 include the promotion of the use of non-fossil resource materials, recycled plastic materials, and materials using natural resources (biomass) to address the market risk that a failure to respond in a timely and appropriate manner to market regulations and customer demands for the use of recycled raw materials could result in a decrease in sales and an increase in procurement costs, and the development of product shapes and manufacturing methods that meet the specifications of products using recycled materials (including biomass plastics).

Those important initiatives are also linked to materiality of “Zero waste (circular economy).” In fiscal 2024, under the name of “XtoCar Project,” we launched an initiative that is a collaboration between manufacturing and other industries (the artery industry) and industries (the vein industry) that recycle and properly dispose of waste to establish a new recycling system to recycle waste plastic from non-automobiles into automotive parts. We aim to mass-produce products for automobiles that use recycled materials in the future. For fiscal 2025, we use the type of waste plastic that can be applied to automobiles as an indicator, targeting to select at least one type of waste plastic through research and analysis.

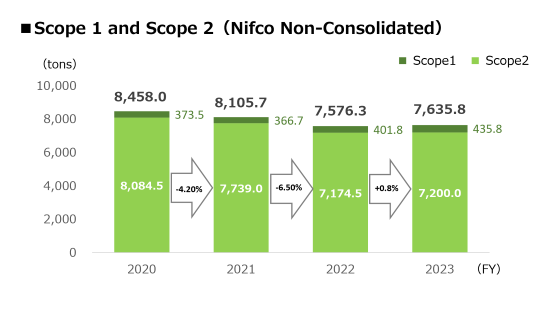

【2】Indicator and targets for realizing “Carbon Neutrality by 2050”

The Company has declared “Carbon Neutrality by 2050” as its medium to long-term strategy to combat climate change. As general guidelines for reducing CO2 emissions, we are working to achieve a 33% reduction from the 2020 level for the Company and the Group companies in Japan by 2030 and realize carbon neutrality by 2050 for Scope 1 and Scope 2. It is planned to start on-site PPA and off-site self-transportation in fiscal 2025 at the Nagoya Plant, with the aim of increasing the ratio of renewable energy year by year and making it a model plant for achieving carbon neutrality at an earlier date. In addition, it is planned to reflect subordinate indicators and targets in the next mediumterm management plan for fiscal 2027.

The latest CO2 emissions for the Company and the Group companies in Japan which have been aggregated are as follows. CO2 emissions have been aggregated using the GHG protocol which has become a global standard method of calculation. Although we continued to promote energy conservation activities, Scope 1 and Scope 2 increased slightly as a result that an increase in energy consumption associated with an increase in production volume exceeded a reduction due to energy conservation, etc., in fiscal 2023. That said, as mentioned above, we aim to implement measures to increase the ratio of renewable energy as much as possible, starting with the Nagoya Plant. In addition,

Scope 3 that is calculated based on the amount of orders, increased due to fluctuations in exchange rates and soaring materials and transportation costs.

We currently disclose CO2 emissions for the Company and the Group companies in Japan only for Scope 1 and Scope 2.

The understanding and disclosure of this information lead to the formulation of action guidelines to maintain competitive advantages by identifying areas and processes that have a significant impact on the Company and within the Group companies in Japan and taking measures in advance to address rising business costs due to tighter regulations on CO2 emissions and the introduction of a carbon tax, as well as rising expectations from customers and business partners for decarbonization, and by concretely identifying the need for the introduction of renewable energy, efficient capital investment, and the development of new technologies. It will strengthen the foundation for sustainable growth and, even within a limited scope of Japan, proactive data disclosure will serve as a means of gaining the trust of

customers and investors who place importance on consideration to the environment and help to expand business opportunities. We believe it will therefore contribute to the future expansion of the Company on a consolidated basis.

At present, data from overseas sites are collected using Excel spreadsheets. We have not yet gone as far as official disclosure from the viewpoint of data accuracy; however, we plan to disclose this as reference values for Scope 1 and Scope 2, starting from fiscal 2025. In the future, we will consider introducing a system with a view to improving data accuracy on a global basis and establishing a management system that can withstand third-party assurance.

In addition, with regard to the calculation of Scope 3 (greenhouse gas emissions in the entire supply chain), it is difficult at present to capture and calculate emissions in a uniform manner due to differences in data retention and management methods across the entire supply chain. For this reason, we disclose CO₂ emissions only for Nifco non-consolidated. In the future, we will strengthen coordination with important affiliated companies and consider the phased preparation and disclosure of Scope 3 data.

While risks and opportunities related to climate change have differing degrees of potential impact, the Company will continue to appropriately implement initiatives through measures for the governance and management of these risks and opportunities in order to maximize corporate value.