Dividend

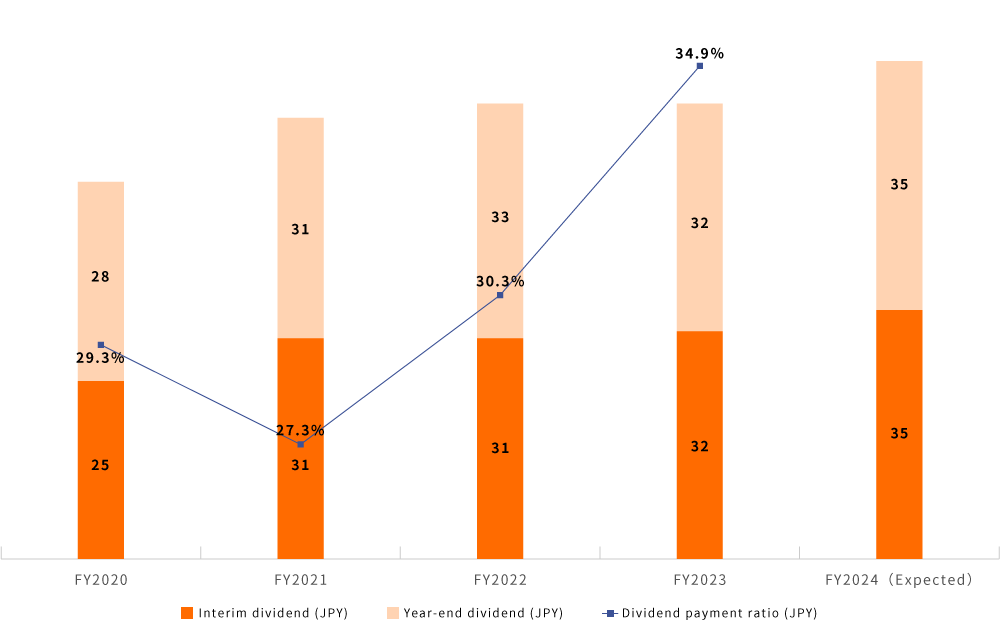

We consider that shareholder return as one of our priority management issues, and we have made it a basic policy to maintain stable dividend payment.

The target dividend payment ratio is about 30%.

Dividend / Dividend payment ratio

| FY2019 | FY2020 | FY2021 | FY2022 | FY2023(Expected) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Interim dividend | Yearend dividend | Interim dividend | Yearend dividend | Interim dividend | Yearend dividend | Interim dividend | Yearend dividend | Interim dividend | Yearend dividend | |

| Dividend per share | 31 yen | 31 yen | 25 yen | 28 yen | 31 yen | 31 yen | 31 yen | 33 yen | 32 yen | 32 yen |

| 62 yen | 53 yen | 62 yen | 64 yen | 64 yen | ||||||

| Dividend payment ratio | 34.9% | 29.3% | 27.3% | 30.3% | ― | |||||

DISCLAIMER

Forward-looking statements or projections included in our website, including earnings projections, are based on currently available information and certain premises that are judged to be rational at the time of this writing.

Actual results may differ greatly from the forecast figures depending on various factors. the data listed in this website is included for the purpose of providing information, it is not designed to encourage investment.